Canadian Occupational Projection System (COPS)

Industrial Summary

Food and Beverage Products

NAICS 3111-3119; 3121; 3122; 3123

This industry comprises establishments primarily engaged in manufacturing food as well as beverage and tobacco products. Food manufacturing is by far the most important segment, accounting for 77% of production in 2021, followed by beverage products (18%) and tobacco products (4%). The industry is largely domestic-oriented as about two thirds of its production is sold within the country. However, foreign markets are representing an increasing share of total sales, with exports accounting for 38% of revenues, up from 24% a decade ago. With a total of 311,500 workers in 2021, it is the largest employer of the manufacturing sector (18% of all manufacturing workers). Most workers are operating in food manufacturing (85%) and employment in the industry is largely concentrated in Ontario (38%) and Quebec (27%), with men accounting for 60% of the workforce. Key occupations (4-digit NOC) include:[1]

- Process control and machine operators, food and beverage processing (9461)

- Labourers in food and beverage processing (9617)

- Supervisors, food and beverage processing (9213)

- Industrial butchers and meat cutters, poultry preparers and related workers (9462)

- Bakers (6332)

- Testers and graders, food and beverage processing (9465)

- Fish and seafood plant workers (9463)

- Labourers in fish and seafood processing (9618)

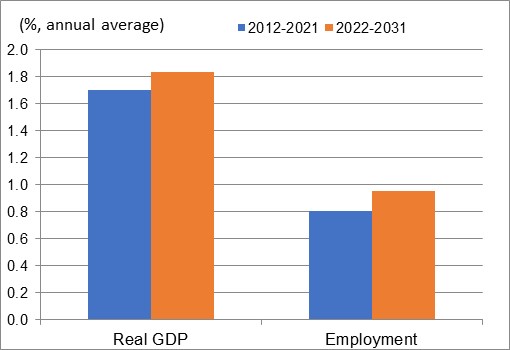

The industry experienced an upward trend in output during most of the past decade, with all three segments recording positive growth. While steady increases in domestic consumption have been the backbone for the food and beverage segments during that period, output growth has been primarily fueled by rising foreign demand, particularly from the U.S. and Asian markets. The decrease in the value of the Canadian dollar since 2014-2015 also provided additional stimulus for exports. With consumers moving away from tobacco products, output in this segment stagnated until 2018, before expanding rapidly in recent years due to the legalization of cannabis in Canada. Growth in the industry’s output was temporarily interrupted in 2020, but in contrast with most other manufacturing industries, the decline in production was marginal during the first year of the COVID-19 pandemic (-1.0%) as food is a necessity. Home confinement also led to significant increases in consumer spending at grocery stores as an alternative to restaurants, boosting output in food and beverage manufactured products in 2021 (+5.4%). The resulting pace of growth in the industry’s real GDP averaged 1.7% annually for the entire period 2012-2021. After peaking in 2019, employment fell sharply in 2020, before rebounding in 2021 but without fully recovering the jobs lost in the previous year. On average, employment increased at annual rate of 0.8% over the past decade, as productivity growth (+0.9% annually) was a significant contributor to output growth. Indeed, the growing presence of foreign competitors in the food and beverage market over the past several years forced the Canadian industry to undertake a significant amount of restructuring and consolidation to remain competitive globally. The larger plants have allowed manufacturers to take greater advantage of economies of scale, as well as containing costs per unit of output. At the same time, capital spending for some food segments has also started to pick up and the shift toward technology boosted productivity in the industry.

Over the period 2022-2031, output growth in the food and beverage manufacturing industry is projected to accelerate marginally relative to the previous decade as faster population growth, driven by higher immigration targets, will support growth in domestic demand. The trend for healthier food, including the choice of consumers to have higher quality, locally sourced and ethical products in a more transparent ecosystem will also benefit Canadian producers. The export-oriented segment of the industry is expected to continue to be supported by a relatively low Canadian dollar and further expansion into new markets through the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). Exports of food products are also expected to benefit from rising incomes and the growing middle class in emerging markets. Developing countries generally have higher population growth rates than developed countries and a greater capacity to increase per-capita consumption of food. In addition to enhancing the price-competitiveness of Canadian exports of food and beverage products, the low value of the Canadian dollar is expected to increase import prices and encourage a shift toward local sourcing and domestic production. While tobacco consumption is projected to keep declining, further growth in the manufacturing of cannabis products is expected to offset this loss.

On the negative side, population aging is expected to restrain growth in demand for food products. It is widely accepted that the need to eat tend to decline as people age. Empirical evidence shows that older people spend a smaller proportion of their income on food and clothing, particularly once they are retired from the labour market. Moreover, the slower pace of growth anticipated in disposable income (resulting from the gradual slowdown in Canada’s employment growth and massive retirements of baby-boomers) is also expected to weigh on consumer spending. Although food is a necessity and is generally less sensitive to fluctuations in household consumption, expenditures on food that are discretionary in nature are more at risk of weaker demand. Overall, the industry’s real GDP is projected to increase at an average of 1.8% annually during the period 2022-2031. The small improvement in output growth and the slight deceleration in productivity growth relative to the past decade are expected to lead to a modest acceleration in employment growth, averaging 1.0% per year. Nevertheless, job creation will continue to be restrained by additional gains in productivity (+0.8% annually) as technological innovations, particularly in advanced robotics, are expected to lead to further increases in the automation of the production process.

Real GDP and Employment Growth Rates in Food and Beverage Products

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

| Real GDP | Employment | |

|---|---|---|

| 2012-2021 | 1.7 | 0.8 |

| 2022-2031 | 1.8 | 1.0 |

Sources: Statistics Canada (historical) and ESDC 2022 COPS industrial projections.

[1]Key occupations for manufacturing industries in general also include: Manufacturing managers (0911); Construction millwrights and industrial mechanics (7311); Material handlers (7452); Shippers and receivers (1521); Transport truck drivers (7511); Industrial engineering and manufacturing technologists and technicians (2233); Industrial electricians (7242); and Industrial and manufacturing engineers (2141).Back to text.